Written by Andy Cave, IMEC Regional Manager

An example of how an accounting approach may hinder continuous improvement efforts

The Accounting concept of Standard Costing was developed in the 1920’s, and its application has remained fairly constant. Manufacturing was noted for minimal product variation (“You can buy a Model T in any color, as long as it’s black”) and long production runs creating lots of inventory whose financial value had to be estimated. Lean principles have changed the manufacturing world significantly, with shorter set-up times and significantly less inventory. Meanwhile, Accounting still spends time analyzing and understanding labor, material and overhead variances; often generating thousands of related transactions and accrual entries. In the Lean world, these are Non Value-Added activities; the customer is not willing to pay more for our cost variance analysis excellence.

A key concept in Lean is Value Streams, where product families flow through dedicated cells of equipment and people. In Lean Accounting, new order acceptance decision-making is made at the Value Stream level, not at the unit cost level. In this process, it is important to understand the aggregate and incremental costs. If we don’t have the capacity to absorb the additional volume, what equipment and / or personnel do we need to add? Does the incremental change positively impact the Value Stream contribution margin?

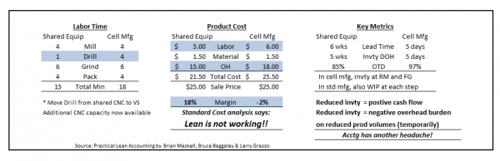

In the example below, we are moving a product from a shared area into a Value Stream. As we are using drill presses instead of CNC machine in the Value Stream, we add 3 min / $1 of labor. In standard cost accounting, this adds $4 to the product cost. The Standard Cost Analysis says that Lean is not working; go back to the old way!! What is really happening is that product velocity through the plant has increased, inventory is lower, customers are getting orders more quickly, and greater profits are realized.

A challenge is to get past the “Product Cost Paradigm”; the need to know the individual product SKU cost to make a decision. There are two key points to remember: 1. Individual product costs are made through a series of assumptions on how to allocate costs including real estate, indirect labor, utilities, and salaries. 2. Product cost does not drive pricing; companies won’t pay more or less based on your product costs.

If we understand the relative contribution of a product to Value Stream margins, and have a fairly controlled manufacturing process with predictable outcomes, we can understand the profitability of a product at the aggregate level. Lean Accounting helps to make better decisions and eliminates non-value added activities, making the accounting team available for value-added activities.

So, pull the team together and have a discussion. How is our Accounting approach supporting, or not, the continuous improvement results that our customers are demanding? What are the differences between product costing and understanding value stream margins in our operation? What decisions are these answers leading us to make? We all agree that eliminating non-value added activities has a meaningful impact on the business. Our challenge is to make our financial reporting more simplified, understandable, useful and impactful for our managerial decisions going forward.

To learn more about the IMEC approach to lean accounting, contact us at 888-806-4632 or send an email to info@imec.org.